On 18 February, 2021, Hybrid CoE organized a webinar in cooperation with Bruegel on money laundering and hybrid threats. Money laundering poses a permanent threat to the financial system, and hence the EU has actively worked at developing prevention mechanisms to combat it. But the COVID-19 pandemic and its economic impact may have magnified the problem and enabled its use as part of a hybrid approach. Many countries, including EU member states, are currently struggling and looking for outside money to shore up their economies. Will the EU and its member states be ready to control this risk – even if competition for financial inflows intensifies?

The webinar recording is available here.

See Hybrid CoE’s Working Paper on hybrid threats in the financial system here.

Summary of the event on money laundering and hybrid threats: Has COVID-19 made it all worse?

Introduction

On 18 February 2021, Hybrid CoE organized a webinar in cooperation with Bruegel on money laundering and hybrid threats. Money laundering poses a permanent threat to the financial system, and hence the EU has been active in developing prevention mechanisms to combat the problem. But the COVID-19 pandemic and its economic impact may have magnified the problem and enabled its use as part of a hybrid approach. Many countries, including EU member states, are currently struggling and looking for outside money to shore up their economies.

Hybrid CoE raised two questions for discussion:

- Is it possible to use money laundering as a “weapon” against smaller economies, and to develop it as a hybrid tool?

- Will the EU and its member states be ready to control this hybrid risk – even if competition for financial inflows intensifies?

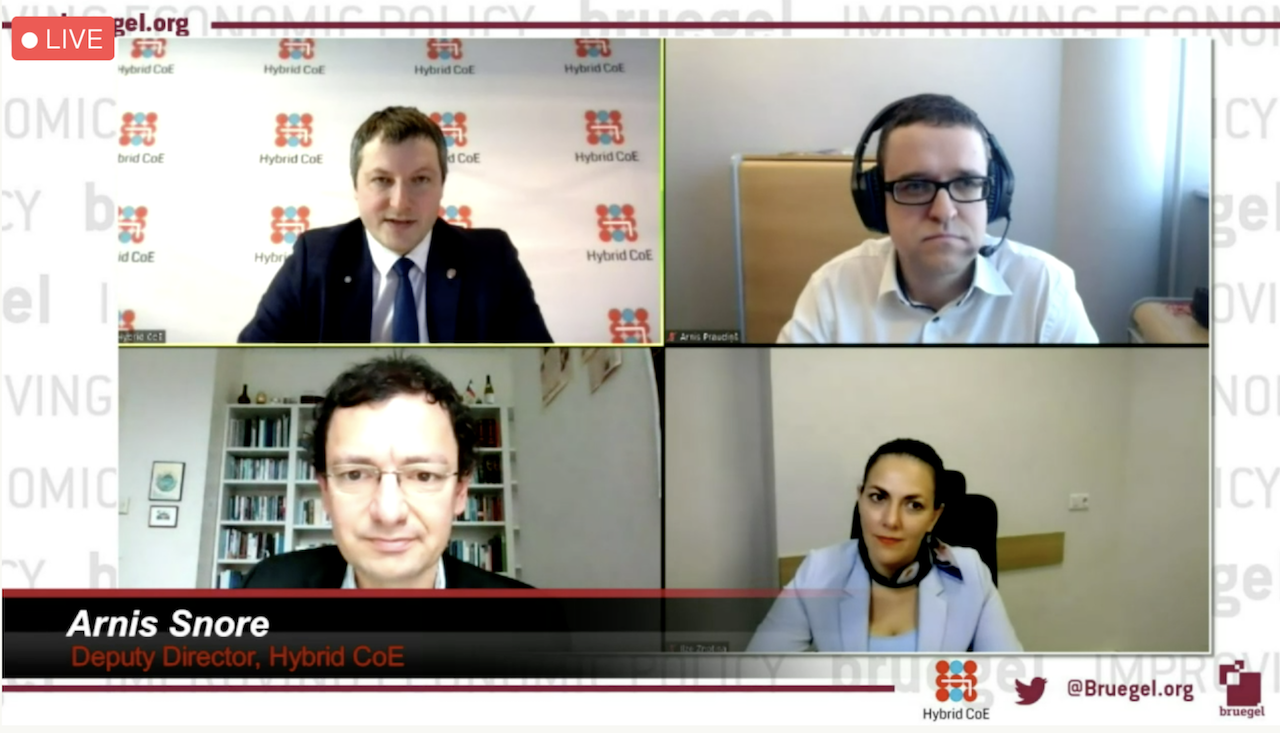

The following experts participated in a panel to discuss the issues:

- Mr Nicolas Véron, Senior Fellow, Bruegel

- Mr Arnis Praudinš, Head of the Financial Crime Risk (Compliance), Swedbank Latvija

- Mrs llze Znotiņa, Head, Financial Intelligence Unit (FIU) of Latvia

- Mr Arnis Šnore, Deputy Director, Community of Interest on Vulnerabilities and Resilience, Hybrid CoE

Discussion: Anti-money laundering measures must remain a priority

Mrs Znotiņa stated thatalthough anti-money laundering (AML) measures during the global pandemic remain a high priority, COVID-19 is certainly not improving any country’s capability to prevent and combat money laundering (ML), including Latvia. There is a clear indication that specific money laundering threats are emerging due to COVID-19. The ML risk profile is being changed as the activity of “non-essential” business is limited and on-site client services are restricted. However, online sales are increasing during COVID-19.

Various support measures to reduce the negative impact of COVID-19 on the Latvian economy are being implemented. As the economy is struggling, this might create ML opportunities, and the impact on financial and social behaviour is obvious due to the closure of businesses, unemployment, and the restructuring of governmental resources.

Cybercrime is another area of concern. The precautionary measures and limitations on the physical movement of individuals increased the demand for online communication and purchases, significantly increasing cybersecurity risks for users. There has been a rise in phishing emails, links to malicious websites, and attachments containing personal information. Specific forms of cyber fraud that have been reported include impersonating public authorities who provide social aid in order to fraudulently obtain funds or personal information; business email compromise scams; and cyber criminals exploiting weaknesses in businesses’ network security to gain access to customer contact and transaction information.

Other common offences (also identified more frequently than in ML cases) were fraud (related to medical equipment, or to economic relief measures or public procurement contracts, intentionally driving legal persons to insolvency); corruption (related to the ease of public procurement procedures to ensure the swift delivery of urgently needed medical supplies); medicrime (the overpricing of low-quality goods as a result of the significant demand for medical equipment and supplies caused by the pandemic); and corruption risks related to COVID-19 vaccine procurement.

Relevant questions in this context are how to balance the issue of attracting investments and protecting the financial system, and how to minimize vulnerabilities and increase resilience.

Latvia wanted to establish a green corridor with Belarusian companies in order to provide them with the opportunity to invest in Latvia, and to continue their activities, which had been suspended at some point by President Lukashenko. Latvia wanted to be the preferred country for these businesses, providing banking services while still protecting the Latvian financial system against possible threats and risks, as the businesses originate from a system where compliance is not at the same level as in Latvia. Strict compliance and the willingness to fight financial crime pose a competitive challenge: countries are caught between a wide range of AML requirements and assessments by various international institutions, which are not homogeneous.

Mr Praudinš reported that AML has been at the top of Latvia’s agenda, and that private banks comply with the highest international standards and havezero tolerance of financial crime.In 2018, credit institutions and payment institutions were banned from cooperating with shell arrangements. Since then, there has been a significant decrease in the non-resident customer deposit market share and outgoing transactions by foreign customers.Latvia is not as attractive as it used to be because of the measures carried out in recent years, which decrease the vulnerabilities and risks of hybrid influence.

Several comprehensive cooperation mechanisms have been developed. The Financial Intelligence Unit (FIU) has utilized a Public-Private Partnership model, and private-private information sharing between banks has been allowed. Every country seeks investments, but a decision should be made on whether it is allowed to accept illegal money during a crisis. More questions could also be asked, such as whether the stability of the global financial system is secured in general, for example against WallStreetBets and social media influence, or Bitcoin price fluctuations or cryptocurrencies. All of these tools are out there, and countries need to be ready to assess their vulnerabilities if such tools are used in a hybrid way against their economy.

The following discussion among the experts covered further areas of concern.

Different EU countries are at different stages of ML assessment and the implementation of AML measures, even with EU directives. It was mentioned that politics should be less of an issue in ML discussions. Small and larger countries should have the same attitude. The European Commission is expected to introduce a legislative proposal on ML supervision this year. It remains to be seen whether it will make a difference. No bureaucracy or document is useful unless there is cooperation among financial actors and FIUs, and – most importantly – information sharing. Every country will have to make a decision on where to draw the line, and with whom they can do business. Countries need to know whether their business partners or their rivals are capable of using these hybrid tools against them.

In the near future, cryptocurrencies will be an issue for the FIU and AML regulation framework.

Latvian FinTech and cryptocurrency risk assessments indicate that there are not that many suspicious transactions related to cryptocurrencies as yet because there are very few service providers for virtual currencies in Latvia. Yet public awareness of FinTech and cryptocurrencies is increasing.

However, cryptocurrencies effectively create another layer, and there will need to be a greater focus on this area. Social media is also an important factor. It is easy to use social media to the extent where a group of people can be led to believe, falsely, that some actions by important actors within the national economy equate with money laundering. The pandemic makes this easier than before, as more and more people are living in their own social bubble.

In general, the political system, politicians, authorities and decision-makers need further awareness-raising, as they have an insufficient understanding of what constitutes financial crime, how to combat it, and how it affects everyone in society. When it comes to European integration, the system is as strong as its weakest link. Hence, there is the potential and the need to do more to limit vulnerabilities and to decrease the likelihood of hybrid threats.

Conclusions

Money laundering is a vulnerability and a potential area for hybrid influence. Nations need to address this issue using best practices or EU guidelines. In a connected world, it is important to take care of the weakest link to avoid potential consequences for everyone. It is crucial to continue to educate politicians and decision-makers about money laundering and hybrid threats. They need to understand the vulnerabilities and be aware of the potential worst-case consequences.

At the community level, the EU needs to continue to work on regulatory frameworks for AML in order to decrease vulnerabilities and increase resilience, taking into account future challenges such as cryptocurrencies and future digital markets.

Many open questions remain, however, and discussion is needed on hybrid influencing tools, including their usage against and impact on democracies. Hybrid CoE will continue to monitor and research hybrid threats in this area and help its Participating States to increase their resilience.